The Federal Reserve spent a lot of 2022 and 2023 narrowly specializing in inflation as policymakers set rates of interest: Costs had been rising manner too quick, so that they turned the central financial institution’s high precedence. However now that inflation has cooled, officers are extra clearly factoring the job market into their selections once more.

One potential problem? It’s a really tough second to evaluate precisely what month-to-month labor market knowledge are telling us.

Jerome H. Powell, the Fed chair, stated throughout a information convention on Wednesday that the best way the job market formed up in coming months may assist to information whether or not and when the central financial institution lowered rates of interest this yr. A considerable weakening may prod policymakers to chop, he steered. If job progress stays speedy and inflation stays caught, alternatively, the mix may maintain the Fed from reducing rates of interest anytime quickly.

However it’s powerful to guess which of these situations could play out — and it’s trickier than standard to find out how scorching as we speak’s job market is, particularly in actual time. Fed officers will get their newest studying on Friday morning, when the Labor Division releases its April employment report.

Hiring has been speedy in latest months. That will sometimes make economists nervous that the economic system was on the cusp of overheating: Companies would threat competing for a similar employees, pushing up wages in a manner that might ultimately drive up costs.

However this hiring growth is totally different. It has come as a wave of immigrants and employees coming in from the labor market’s sidelines have helped to notably enhance the provision of candidates. That has allowed firms to rent with out depleting the labor pool.

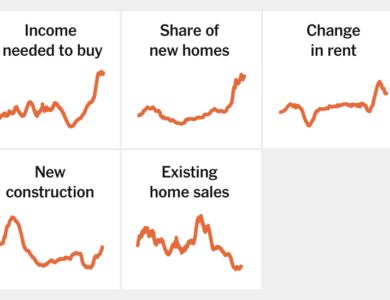

But the bounce in accessible employees has additionally meant {that a} major measure that economists use in assessing the job market’s energy — payroll positive factors — is not offering a transparent sign. That leaves economists turning to different indicators to guage the energy of the job market and to forecast its ahead momentum. And people measures are delivering totally different messages.

Wage progress remains to be very strong by some gauges, but it surely appears to be cooling by others. Job openings have been coming down, the unemployment rate has ticked up just lately (significantly for Black workers) and hiring expectations in business surveys have wobbled.

The takeaway is that this appears to be a robust job market, however precisely how sturdy is difficult to know. It’s even tougher to guess how a lot oomph will stay within the months to come back. If job positive factors had been to gradual, would that be an indication that the economic system was starting to buckle, or simply proof that employers had lastly sated their demand for brand new hires? If job positive factors had been to remain sturdy, would that be an indication that issues had been overheating, or proof that labor provide was nonetheless increasing?

“By way of a pre-pandemic lens, the economic system seems to be fairly sturdy, perhaps even scorching,” stated Ernie Tedeschi, a analysis scholar at Yale Regulation College who was, till this spring, a White Home financial adviser. However given the entire positive factors to labor provide, “perhaps we shouldn’t use a pre-pandemic lens for serious about the economic system proper now,” he stated.

Friday’s report is predicted to indicate that job positive factors remained speedy in April: Economists are forecasting a 240,000 individual bounce in payrolls, in line with a Bloomberg survey.

That will proceed the development over the previous yr. The economic system added 247,000 jobs monthly on common from March 2023 to March 2024. To place that in context, the economic system had added 167,000 jobs a month within the yr by March 2019, the spring earlier than the onset of the coronavirus pandemic.

The Fed’s coverage committee voted this week to maintain rates of interest at 5.3 p.c, the place they’ve been set since July. Mr. Powell signaled that they’re more likely to keep at that comparatively excessive degree longer than beforehand anticipated, as officers await proof that inflation is poised to chill additional after months of stalled progress.

However whereas the trail forward for value will increase would be the predominant driver of coverage, Mr. Powell stated that “as inflation has come down, now to under 3 p.c,” employment additionally “now comes again into focus.”

For now, Fed officers haven’t been overly nervous about speedy job positive factors. Mr. Powell famous on Wednesday that the economic system had been capable of develop extra strongly in 2023 partly as a result of the labor provide had expanded a lot, each due to immigration and since extra folks had been taking part within the job market.

“Keep in mind what we noticed final yr: very sturdy progress, a very tight labor market and a traditionally quick decline in inflation,” Mr. Powell stated. “I wouldn’t rule out that one thing like that may proceed.”

Then again, Mr. Powell hinted that Fed officers had been keeping track of wage progress. He steered repeatedly that sturdy wage will increase alone wouldn’t be sufficient to drive the Fed’s selections.

However the Fed chair nonetheless signaled that latest wage positive factors had been stronger than the Fed thought can be per low and steady inflation over time. As firms pay extra to draw employees, many economists assume that they’re more likely to increase costs to cowl climbing labor prices and shield revenue margins.

Pay positive factors stay sturdy by key measures. Knowledge this week confirmed {that a} measure of wages and advantages that the Fed watches intently, referred to as the Employment Value Index, climbed extra quickly than anticipated at first of 2024.

“We don’t goal wage will increase, however within the longer run, in case you have wage will increase operating greater than productiveness would warrant, there can be inflationary pressures,” Mr. Powell stated this week. In relation to slowing down wage positive factors to a sustainable tempo, “we have now a methods to go on that.”

Whether or not job positive factors and wage positive factors will stay so speedy is unclear.

Invoice Kasko, the president of a white-collar employment placement company in Texas, stated that whereas he continued to see sturdy demand for employees, he additionally observed employers changing into pickier because the outlook for rates of interest and the looming presidential election stoked uncertainty. They wished to see extra job candidates, and take longer to make selections.

“There’s nonetheless demand, it’s simply not transferring as shortly,” Mr. Kasko stated.

If employers begin to pull again extra concertedly, Mr. Powell made clear this week {that a} “significant” bounce in joblessness may prod the central financial institution to decrease charges.

The upshot? It appears as if officers can be extra alarmed by a marked job market slowdown than by sturdy continued payroll positive factors, particularly when it’s laborious to inform whether or not strong hiring numbers sign that the labor market is scorching or just that it’s altering.

“There’s an asymmetry in how they view the labor market,” stated Michael Feroli, the chief U.S. economist at J.P. Morgan.

Ben Casselman contributed reporting.